Get the free bonus depreciationsection 179 form - ksrevenue

Show details

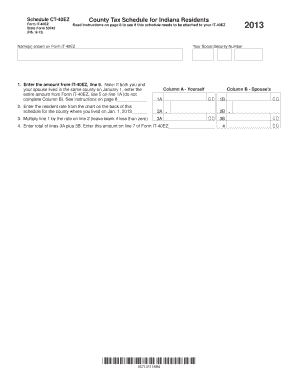

Sixty percent 60 multiplied by 1 160 equals 696 which is to be added back to Kansas on K-120EX PART A line 2. If you file a paper return you must enclose federal Form s 4562 with each K-120EX and any additional schedule necessary to enable KDOR Kansas Department of Revenue to reconcile the federal Form 4562 amounts to the expensing claimed on your K-120EX. Complete lines 1 through 5 of PART A for the shareholders or partners portion and supply th...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your bonus depreciationsection 179 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bonus depreciationsection 179 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing bonus depreciationsection 179 form online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit bonus depreciationsection 179 form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

How to fill out bonus depreciationsection 179 form

How to Fill Out Bonus Depreciation Section 179 Form:

01

Gather the necessary information: Before starting to fill out the form, make sure you have all the relevant information, such as the property details and purchase date, costs incurred, and any depreciation taken in previous years.

02

Identify if you qualify: Determine if you meet the eligibility criteria for claiming bonus depreciation or Section 179 deduction. These deductions are generally available for businesses that have acquired qualified property for use in their trade or business.

03

Complete the basic information: Start filling out the form by entering your name, business name (if applicable), tax identification number, and other required identifying information.

04

Indicate the type of property: Specify the type of property for which you are claiming bonus depreciation or Section 179 deduction. This could include tangible property, computer software, or qualified improvement property.

05

Provide property details: Fill in the necessary details about the property, such as the date it was acquired and placed in service, original cost, and any other relevant information required by the form.

06

Calculate depreciation: Determine the bonus depreciation or Section 179 deduction amount by following the instructions provided on the form. Different rules and limits apply depending on the type of property and specific circumstances.

07

Complete any additional sections: Depending on your situation, there may be additional sections or schedules that need to be filled out. Carefully review the instructions to ensure you provide all the required information.

08

Review and sign: Before submitting the form, carefully review all the information you have filled out to ensure accuracy. If everything is correct, sign the form and date it according to the instructions provided.

Who Needs Bonus Depreciation Section 179 Form?

01

Businesses acquiring qualified property: Any business that has acquired qualified property for use in their trade or business may need to fill out the bonus depreciation Section 179 form. This includes both sole proprietorships and entities such as partnerships, corporations, or LLCs.

02

Taxpayers claiming bonus depreciation or Section 179 deduction: Individuals or entities who want to claim bonus depreciation or the Section 179 deduction on their tax return will likely need to complete this form. These deductions can provide significant tax advantages by accelerating the depreciation expense or claiming the deduction in the year the property was purchased.

03

Businesses seeking to reduce taxable income: The bonus depreciation and Section 179 deduction options are often used by businesses to reduce their taxable income and lower their overall tax liability. By completing this form accurately, businesses can take advantage of these deductions and potentially save money on their taxes.

Note: It is important to consult with a tax professional or refer to the official IRS guidelines for specific instructions and requirements related to filling out the bonus depreciation Section 179 form.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is bonus depreciationsection 179 form?

Bonus depreciation and section 179 are tax incentives that allow businesses to deduct the full cost of certain assets in the year they are purchased, rather than depreciating them over time.

Who is required to file bonus depreciationsection 179 form?

Businesses that have purchased eligible assets and want to take advantage of the tax incentives provided by bonus depreciation and section 179 are required to file the relevant forms.

How to fill out bonus depreciationsection 179 form?

To fill out the bonus depreciationsection 179 form, businesses will need to provide information about the assets purchased, their cost, and when they were placed in service. They will also need to calculate their depreciation deduction and report it on their tax return.

What is the purpose of bonus depreciationsection 179 form?

The purpose of the bonus depreciationsection 179 form is to allow businesses to take advantage of tax incentives that can help them save money on their tax liabilities.

What information must be reported on bonus depreciationsection 179 form?

The bonus depreciationsection 179 form requires businesses to report details about the assets they have purchased, including their cost, when they were placed in service, and the amount of depreciation they are claiming.

When is the deadline to file bonus depreciationsection 179 form in 2023?

The deadline to file the bonus depreciationsection 179 form in 2023 is typically the due date for the business's tax return, which is usually March 15th for calendar year taxpayers.

What is the penalty for the late filing of bonus depreciationsection 179 form?

The penalty for late filing of the bonus depreciationsection 179 form is typically a percentage of the tax owed, calculated based on the number of days the form is late. The penalty can vary depending on the amount of tax owed and the length of the delay.

How can I send bonus depreciationsection 179 form to be eSigned by others?

Once your bonus depreciationsection 179 form is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I execute bonus depreciationsection 179 form online?

With pdfFiller, you may easily complete and sign bonus depreciationsection 179 form online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I edit bonus depreciationsection 179 form straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing bonus depreciationsection 179 form, you need to install and log in to the app.

Fill out your bonus depreciationsection 179 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.